Harga BBNI meluncur tajam di bulan April, apakah kita perlu khawatir?

Recent newsHarga BBNI meluncur tajam di bulan April 2024, apakah kita perlu khawatir! Tentu tidak! Karena dari analisa nya sebenarnya sudah sangat aman!

read more(Comments)

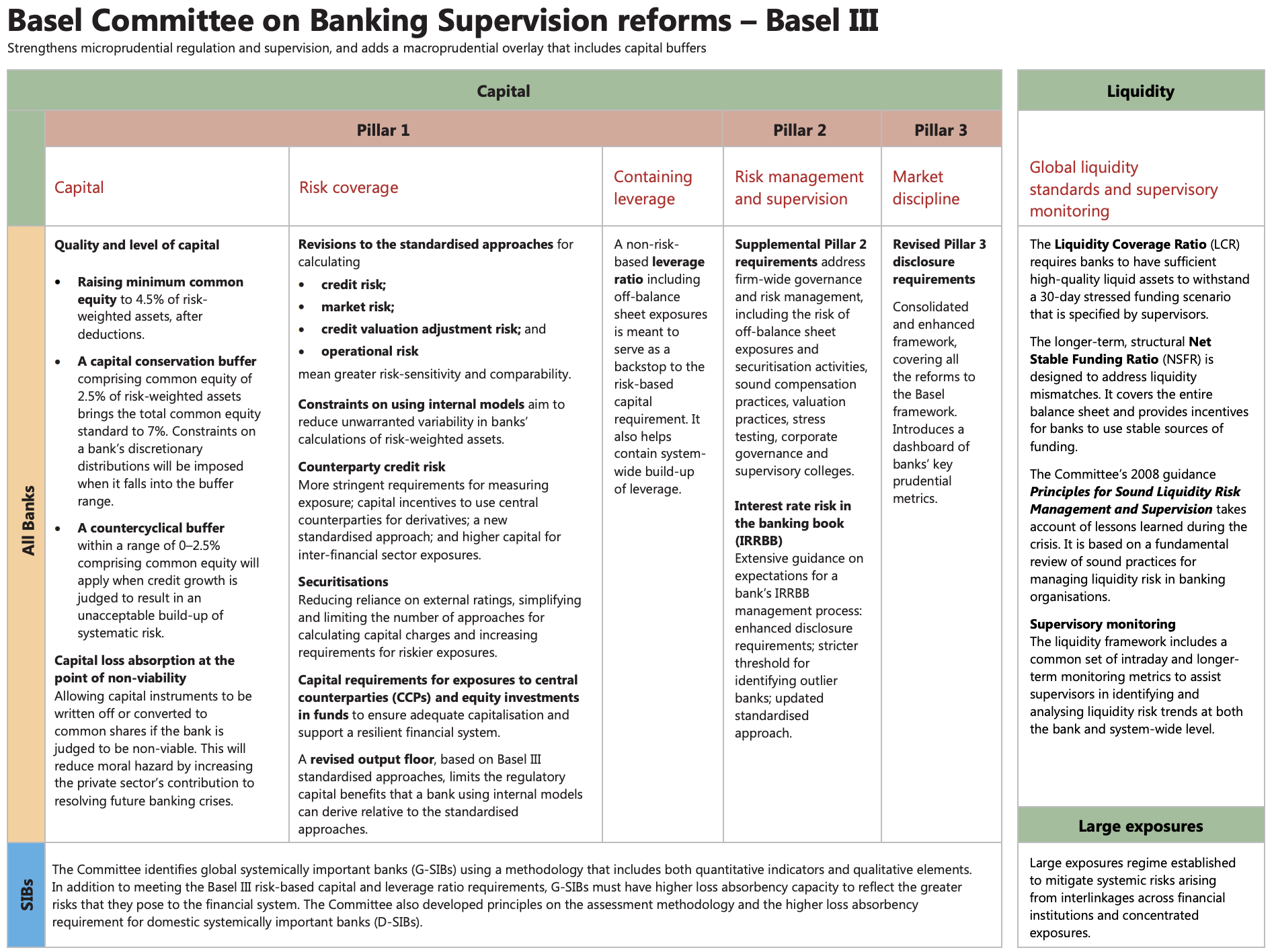

For people who have been in the banking sector, perhaps the words ALMA are not unfamiliar terms. ALMA or Asset and Liability Management is a risk application process in commercial banks. The Bank implements ALMA to carry out controlling interest rate risk, exchange rate risk, and liquidity risk. One of the ratios that are often used to assess liquidity risk is LDR (loan to deposits ratio). LDR is the ratio between the total volume of loans disbursed by banks and the number of funds received from various sources.

Sources of bank funds generally come from third-party funds collected by banks, which will then be distributed in credit. So, if the LDR ratio is getting lower, it can be said that there are a lot of idle funds that have not been channelled in the form of loans, but on the other hand, banks have excellent liquidity capabilities. On the other hand, if the LDR is too high, the distribution of third party funds to credit is optimal, but the Bank's liquidity capacity is not good. LDR is also called the ratio of credit to total third party funds, used to measure third party funds channelled in the form of credit.

Credit distribution is the main activity of banks; therefore, the primary source of income for banks comes from this activity. The greater the disbursement of funds in the form of credit compared to deposits or public deposits in a bank, the consequence is more significant the risk that must be borne by the Bank concerned.

The critical purpose of calculating LDR is to determine the extent to which the Bank's health condition is in carrying out its operations or business activities. In other words, LDR is used as an indicator to determine the soundness of a bank.

So LDR currently functions as an indicator of banking intermediation. Once the importance of the LDR for banks, the current LDR figure has been used as a requirement, including:

1. As one of the indicators for assessing the soundness of a bank.

2. As a determining factor for the size of a bank's Statutory Reserves (GWM).

This LDR policy is handled in PBI No. 15/15/PBI/2013 concerning Statutory Reserves for Commercial Banks in Rupiah and Foreign Exchange for Conventional Commercial Banks. However, according to Bank Indonesia Regulation No. 17/11/PBI/2015 dated 26 June 2015, the formula for loan to deposit ratio (LDR) was changed to include securities in the LDR calculation, so its name was changed to loan to funding ratio (LFR). It was changed by expanding the funding component to encourage more outstanding lending to the Micro, Small and Medium Enterprises (MSME) sector.

The Director of the BI Macroprudential Policy Department, Yati Kurniati, said that the issuance of this policy was motivated by moderate economic growth and the potential for change to be lower than initially estimated. This condition was also accompanied by a slowdown in economic growth followed by a slowdown in credit. As a result, this condition can increase risks to financial system stability.

According to Yati, the expansion of the funding component does not only come from third party funds (DPK). But also, by including securities (SSB) issued by banks in the calculation of Statutory Reserves-LDR. However, the term LDR, continued Yati, was changed to Loan to Funding Ratio (LFR), with the ratio remaining the same. "So the funding source is not only TPF but also securities issued by banks. So that the space for disbursing credit becomes bigger too," said Yati.

In addition, the development of the LFR is also expected to provide more excellent room for lending. This is because the provision of incentives in the form of relaxation of the upper limit for calculating the LFR reaches 94 per cent. "Banking LFR expansion is expected to have a larger room to channel credit because the LFR limitation remains at 78-92 per cent but with a larger divisor," he explained.

According to him, the inclusion of SSB in the funding component encourages banks to have other alternative sources of financing immediately. In addition, the issuance of SSB by banks also makes Indonesia's financial market more developed.

Harga BBNI meluncur tajam di bulan April 2024, apakah kita perlu khawatir! Tentu tidak! Karena dari analisa nya sebenarnya sudah sangat aman!

read moreApakah kita perlu khawatir dengan harga saham yang meluncur tajam?

read moreToday, one of the popular topic related to financial policy is the question on

read moreHave you ever heard about LTV? well if you talk about Macroprudential policy, it will be loan to value. But if you talk about startups and the world of tech, it refers to the Lifetime value of a company.

read moreAkhirnya Indonesia menerapkan kurikulum merdeka, namun sebenarnya apa sih itu kurikulum merdeka?

read moreI tried from my own research. And here it is

read more

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments