Harga BBNI meluncur tajam di bulan April, apakah kita perlu khawatir?

Recent newsHarga BBNI meluncur tajam di bulan April 2024, apakah kita perlu khawatir! Tentu tidak! Karena dari analisa nya sebenarnya sudah sangat aman!

read more(Comments)

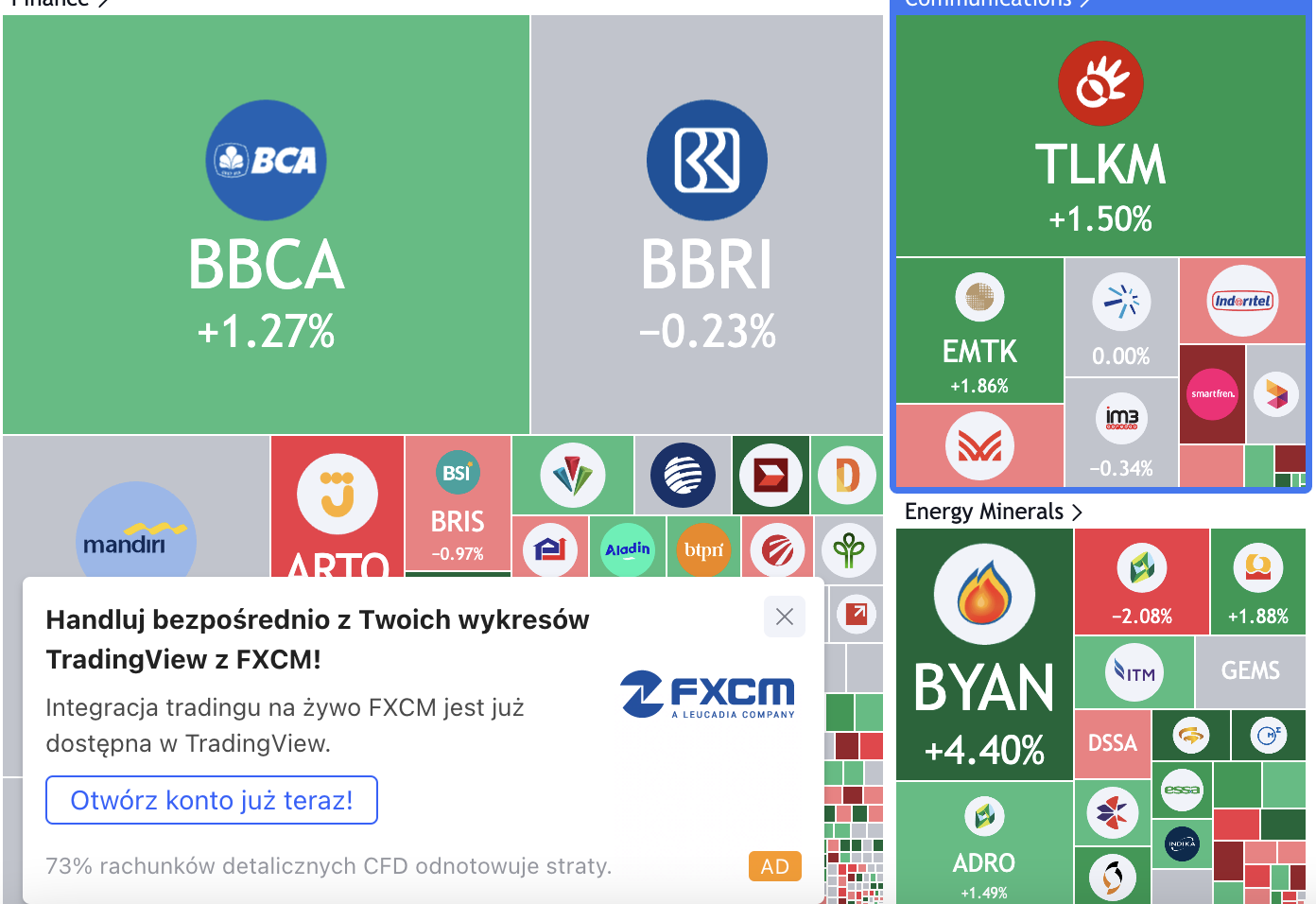

The global economy has been heavily reliant on fossil fuels for centuries, and coal has been one of the most widely used energy sources. However, with the increasing concerns about climate change, many investors and businesses are questioning the viability of investing in coal and mining in 2023. In this blog post, we will explore the reasons why investing in coal and mining may not be a wise decision in the current climate.

First and foremost, the global movement towards renewable energy is rapidly accelerating. Many countries, including the United States, China, and the European Union, have set ambitious targets to reduce their greenhouse gas emissions and transition to renewable energy sources. This has led to a sharp decline in demand for coal, as it is one of the most carbon-intensive fuels. In addition, the cost of renewable energy is rapidly declining, making it increasingly competitive with traditional fossil fuels.

Another reason why investing in coal and mining may not be a wise decision is the increasing regulatory pressure. Governments around the world are implementing stricter regulations on carbon emissions, which could significantly impact the coal and mining industries. For example, the European Union has introduced a carbon border tax, which will require importers of certain goods, including steel and aluminum, to pay a tax based on the carbon emissions associated with their production. This could significantly impact the competitiveness of coal and mining companies, as they are among the largest emitters of carbon dioxide.

Moreover, the environmental impact of coal and mining is becoming increasingly apparent. Mining activities can cause significant damage to the environment, including the destruction of habitats, pollution of waterways, and land degradation. Coal mining can also have significant health impacts on local communities, such as respiratory illnesses, due to exposure to coal dust. The negative impact of coal and mining on the environment and human health is increasing pressure on governments to regulate these industries more strictly.

Additionally, investing in coal and mining is becoming increasingly risky due to the rise of alternative investment opportunities. As the world shifts towards a low-carbon economy, investors increasingly seek opportunities to invest in renewable energy, energy storage, and other clean technologies. These sectors are rapidly growing, and many analysts predict they will outperform traditional fossil fuel investments in the coming years.

Finally, the financial performance of coal and mining companies is becoming increasingly volatile. The coal industry has declined for years, and many companies have struggled to remain profitable. The recent economic downturn caused by the COVID-19 pandemic has further impacted the profitability of these industries, as demand for coal has fallen sharply. Furthermore, the increasing pressure from investors and governments to transition away from fossil fuels could result in significant financial losses for those invested in coal and mining.

In conclusion, investing in coal and mining may not be wise in 2023 and beyond. The rapid shift towards renewable energy, increasing regulatory pressure, environmental impact, alternative investment opportunities, and financial volatility suggest that coal and mining investments could become increasingly risky and unprofitable. Instead, investors should consider opportunities in the rapidly growing clean energy sector, poised to outperform traditional fossil fuels in the coming years.

It is essential for investors to keep up-to-date with the latest trends in the energy sector and make informed investment decisions. By taking a long-term view and considering the potential risks and opportunities associated with different energy investments, investors can benefit from the transition towards a low-carbon economy while supporting the fight against climate change.

As the world faces increasing environmental challenges, it is important to take a responsible and sustainable approach to investing. By avoiding investments in coal and mining, investors can help reduce their environmental impact and support the transition toward a cleaner and more sustainable future.

Harga BBNI meluncur tajam di bulan April 2024, apakah kita perlu khawatir! Tentu tidak! Karena dari analisa nya sebenarnya sudah sangat aman!

read moreApakah kita perlu khawatir dengan harga saham yang meluncur tajam?

read moreToday, one of the popular topic related to financial policy is the question on

read moreHave you ever heard about LTV? well if you talk about Macroprudential policy, it will be loan to value. But if you talk about startups and the world of tech, it refers to the Lifetime value of a company.

read moreAkhirnya Indonesia menerapkan kurikulum merdeka, namun sebenarnya apa sih itu kurikulum merdeka?

read moreI tried from my own research. And here it is

read more

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments