Potongan cerita pendek - kelas kosong masa SMA yang mengingatkanku pada dirinya

Recent newsCerita ini fiksi belaka, kemiripan dengan kejadian sesungguhnya hanyalah kebetulan, atau dirimu memang ingin membuatnya kebetulan 😅

read more(Comments)

A fundamental tenet of monetary policymaking is that a surprise increase in the short-term interest rate will lower price inflation from what it otherwise would have been.

Thus, it has been disconcerting to macroeconomists that many empirical estimates of the relationship between the federal funds rate and inflation have suggested that a surprise interest rate hike is followed immediately by a sustained increase in the inflation rate. This result has become known as the “price puzzle,” starting with Eichenbaum (1992). Hanson (2004) showed that it is not easy to explain away the price puzzle, especially in the pre-1980 period.

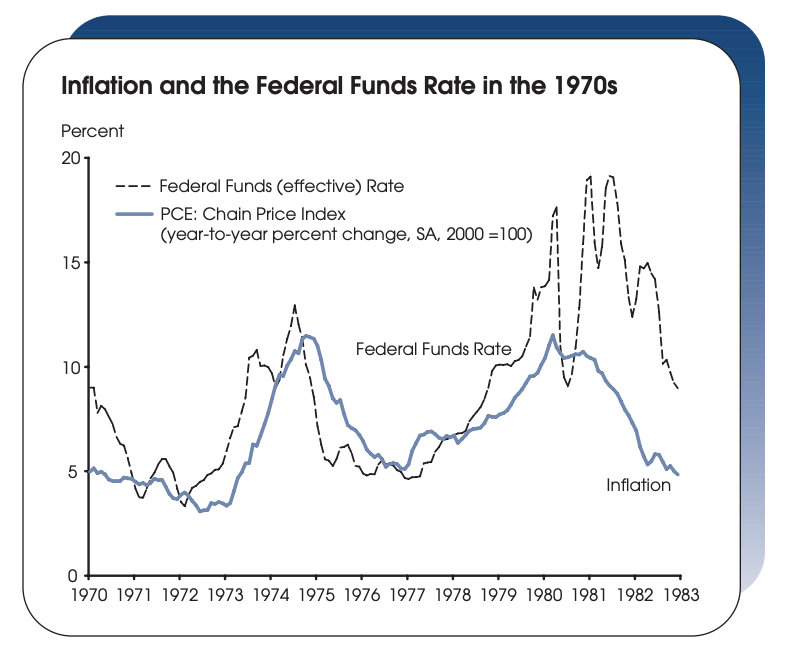

The attached chart highlights circumstances in which the price puzzle flourished; specifically, it shows the tendency of the federal funds rate to precede change in inflation in the same direction during the 1970s. Interpretations of the price puzzle can differ in an important aspect: A conventional view is that nobody should believe that surprise interest rate hikes are ever inflationary in reality.

According to this view, any empirical finding of the price puzzle is necessarily a false reading and a sign of a problem with the empirical model that generated such a result. A relatively new explanation for the price puzzle admits the possibility that surprise interest rate hikes really could be inflationary in some circumstances. The view that the price puzzle is a genuine phenomenon— especially in the pre-1980 period—can be based on indeterminacy.

Loosely speaking, an economy’s characteristics correspond to indeterminacy when there is no way to identify the exact sources of forecast errors (for inflation and GDP, for example) in terms of clearly identifiable sources of shocks (such as surprise changes in the federal funds rate and productivity surprises).

In general, it is possible to show in a macroeconomic model that some combinations of characteristics (such as how risk-averse people are, how sticky prices are updated, and how monetary policy is set) pertain to “determinacy” and others pertain to “indeterminacy.” Lubik and Schorfheide (2003) provided the necessary tools to allow for empirical estimates of an economy under indeterminacy. Hence, only recently have macroeconomists been able to explore how closely the data from a given time period conform to determinacy or indeterminacy.

Belaygorod and Dueker (2006) estimate a model of the U.S. economy that also attempts to discern the precise period when indeterminacy was relevant. Their estimates suggest that the indeterminacy period was roughly from 1972 through 1981.

Importantly for the price puzzle, the model estimates imply that in this period of indeterminacy, inflation would rise immediately and in a sustained fashion in response to an interest rate hike. Reassuringly for monetary policymakers, the model estimates for both determinacy periods—before 1972 and after 1981— suggest that increases in the federal funds rate unambiguously help rein in inflation.

In the type of model Belaygorod and Dueker estimated, indeterminacy occurs when monetary policy is too passive in terms of raising the federal funds rate in response to an increase in inflation.

Thus, one understanding of the Great Inflation of the 1970s and early 1980s that can come from the indeterminacy explanation of the price puzzle is that monetary policymakers have a devil of a time extricating the economy from indeterminacy. Once people in the economy come to believe in the price puzzle—that interest rate hikes are inflationary—how do monetary policymakers persuade people to believe again in the determinacy regime, wherein interest rate hikes would reduce inflation? The lesson policymakers seem to have learned is to avoid this trap in the first place by remaining active inflation fighters in order to preserve people’s beliefs indeterminacy.

Reference:

Michael J. Dueker Belaygorod, Anatoliy and Michael Dueker. “Timing Transitions Between Determinate and Indeterminate Equilibria in DSGE Models: Benefits and Implications.” Working Paper 2006-025, Federal Reserve Bank of St. Louis.

Eichenbaum, Martin. “Interpreting Macroeconomic Time Series Facts: The Effects of Monetary Policy: Comments.”

European Economic Review, June 1992, 36, pp. 1001-11. Hanson, Michael. “The ‘Price Puzzle’ Reconsidered.” Journal of

Monetary Economics, October 2004, 51, pp. 1385-413. Lubik, Thomas and Schorfheide, Frank. “Computing Sunspot

Equilibria in Linear Rational Expectations Models.” Journal of Economic Dynamics and Control, November 2003, 28, pp. 273-85.

Cerita ini fiksi belaka, kemiripan dengan kejadian sesungguhnya hanyalah kebetulan, atau dirimu memang ingin membuatnya kebetulan 😅

read moreDalam konteks formulir C Plano pada Pilkada, singkatan “KWK” berarti “Kepala Wilayah Kerja”. Formulir C1-KWK Plano adalah catatan hasil penghitungan suara di Tempat Pemungutan Suara (TPS) yang digunakan dalam Pemilihan Kepala Daerah dan Wakil Kepala Daerah. Formulir ini mencatat secara rinci perolehan suara di setiap TPS dan merupakan bagian penting dalam proses rekapitulasi suara.

read moreThe **Department of Government Efficiency (DOGE)** is a proposed initiative by President-elect Donald Trump, aiming to streamline federal operations and reduce wasteful spending. Announced on November 12, 2024, the department is set to be co-led by tech entrepreneur Elon Musk and former Republican presidential candidate Vivek Ramaswamy.

read moreKyle Singler is a former professional basketball player known for his collegiate success at Duke University and his tenure in the NBA.

read morePete Hegseth is an American television host, author, and Army National Guard officer, recently nominated by President-elect Donald Trump to serve as the United States Secretary of Defense.

read moreAnne Applebaum is a renowned journalist, historian, and author whose works delve into some of the most pressing and complex topics of the modern era. Her expertise lies in examining the intricacies of authoritarian regimes, the rise of populism, and the fragility of democratic institutions. Her Pulitzer Prize-winning book, "Gulag: A History," offers an in-depth exploration of the Soviet labor camp system, shedding light on the human suffering and ideological underpinnings of one of the 20th century’s most oppressive systems.

read morePlexity AI is a marvel of our times—a confluence of technological ingenuity and the boundless hunger for understanding. At its core, Plexity AI represents an advanced synthesis of artificial intelligence and machine learning, built not merely to mimic thought but to empower it. Unlike earlier iterations of AI, which focused on specialized tasks or data crunching, Plexity seems designed to operate as an expansive intellectual partner, capable of untangling the Gordian knots of complexity that define the modern era.

read more

Collaboratively administrate empowered markets via plug-and-play networks. Dynamically procrastinate B2C users after installed base benefits. Dramatically visualize customer directed convergence without

Comments